Loan Calculator

When faced with the prospect of taking out a loan, one of the most pressing questions is usually: “How much will my monthly payments be?” This is where a loan calculator becomes an invaluable tool. In this guide, we’ll walk you through how to calculate your monthly loan payments, understand how much interest you’ll pay, and how to effectively use various loan calculators to manage your finances better.

What is a Loan Calculator?

A loan calculator is a digital tool that helps you figure out the total cost of a loan, including monthly payments and interest. By inputting the loan amount, interest rate, and loan term, you can quickly determine how much you’ll need to budget each month to stay on top of your debt.

Why Use a Loan Calculator?

Loan calculators make it easier to plan for the future. They provide clarity on how much a loan will cost over time, helping you avoid financial pitfalls. You can compare different loan options and choose the one that best fits your budget.

How to Calculate Monthly Payments on a Loan

Calculating the monthly payment on a loan involves understanding the loan’s principal, interest rate, and term. The formula used in most loan calculators is:

M=(1+r)n−1P×r×(1+r)n

Where:

- ( M ) is the monthly payment.

- ( P ) is the principal loan amount.

- ( r ) is the monthly interest rate (annual rate divided by 12).

- ( n ) is the total number of payments (loan term in months).

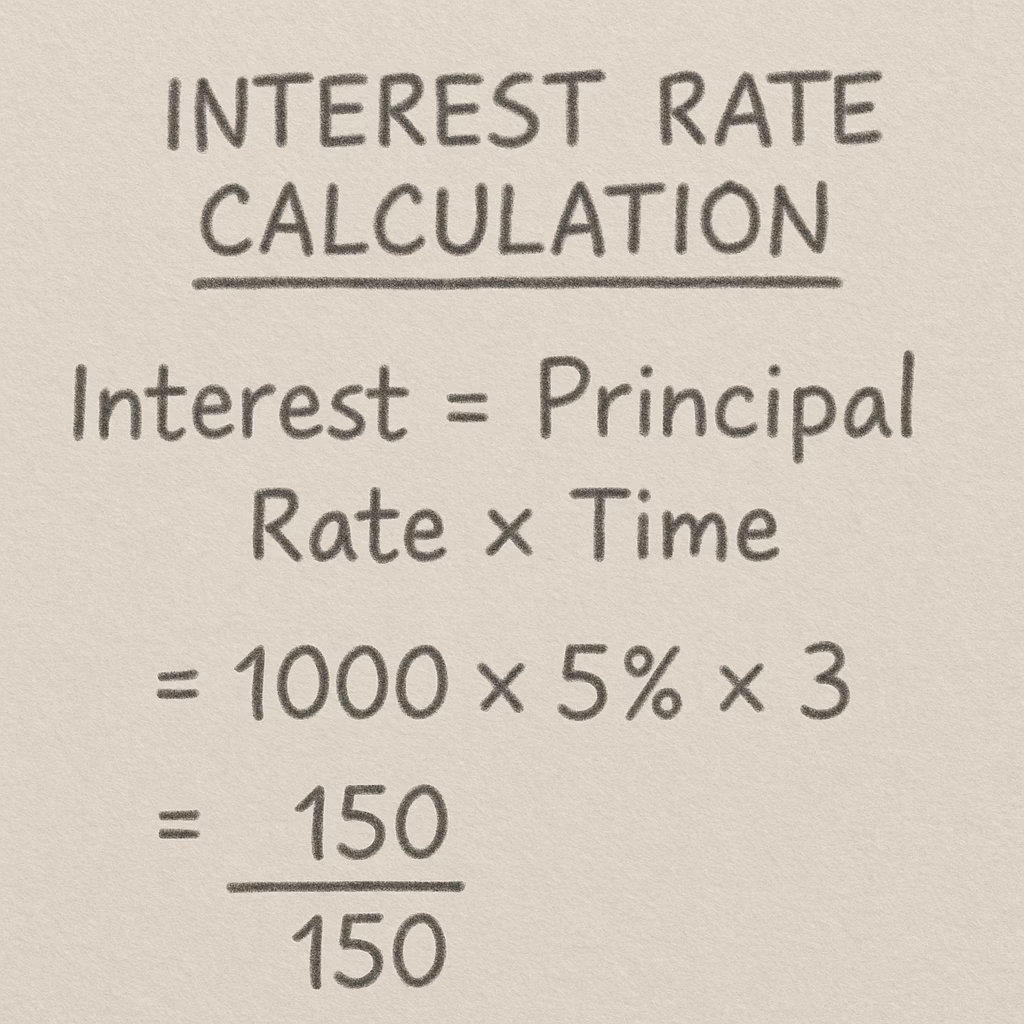

Example: Calculating a $5,000 Loan

If you’re considering a $5,000 loan with a 5% annual interest rate over a 3-year term, you’d first convert the annual rate to a monthly rate by dividing by 12, which is approximately 0.004167. Then, you’d multiply the number of years by 12 to find the term in months, which is 36 months. Plugging these into the formula gives you a monthly payment of about $150.

How Much Interest Will I Pay?

Understanding how much interest you will pay over the life of a loan is crucial for financial planning. The interest is what you pay the lender for borrowing the money, and it can add up over time.

Calculating Total Interest Paid

To find out how much interest you’ll pay over the life of the loan, you can use the formula:

[ \text{Total Interest} = (M \times n) – P ]

This formula subtracts the original loan amount from the total amount paid over the loan term to give you the total interest paid.

Using a Loan Calculator App

Today, there are many loan calculator apps available that simplify these calculations. These apps are designed to be user-friendly and can provide you with detailed insights into various loan scenarios.

Features to Look For

- Ease of Use: The app should be intuitive and easy to navigate.

- Multiple Loan Types: It should allow calculations for different types of loans, like personal, auto, or mortgage loans.

- Detailed Breakdown: Look for an app that provides a breakdown of principal and interest payments over time.

- Amortization Schedules: These show how your payments are applied to the principal and interest over the life of the loan.

Practical Steps to Calculate Loan Payments

Step 1: Determine Your Loan Details

Gather the necessary information about your loan:

- Loan amount

- Interest rate

- Loan term

Step 2: Choose a Calculator or App

Select a loan calculator or app that suits your needs. Many online calculators can handle these calculations, or you can download an app for on-the-go calculations.

Step 3: Input Your Information

Enter your loan details into the calculator. Make sure you select the correct loan type if the calculator has multiple options.

Step 4: Analyze the Results

Once you’ve input your data, the calculator will provide your monthly payment amount and total interest. Use this information to make informed financial decisions.

Advanced Tips for Using Loan Calculators

Explore Different Scenarios

Try entering different loan amounts, interest rates, and terms to see how they affect your payments. This can help you find the most affordable option.

Consider Extra Payments

If you’re able to make extra payments, many calculators allow you to see how this would reduce your loan term and total interest paid.

Compare Lenders

Use loan calculators to compare offers from different lenders. Even a slight difference in interest rates can significantly impact your total payments.

Conclusion

Using a loan calculator is a straightforward way to gain control over your finances. By understanding how to calculate loan payments and interest, you can make better borrowing decisions and manage your debt more effectively. Whether you’re planning to take out a new loan or refinance an existing one, these tools can provide the insights you need to proceed with confidence.